Your future finance organisation starts here

- finance

Through 2025, 75% of enterprises will accelerate their digital transformation plans to navigate today’s challenges, according to Gartner...

Through 2025, 75% of enterprises will accelerate their digital transformation plans to navigate today’s challenges, according to Gartner...

Through 2025, 75% of enterprises will accelerate their digital transformation plans to navigate today’s challenges, according to Gartner (Gartner: Forecast Analysis: Digital Business Consulting Services, Worldwide, 14 March 2022).

For you, as a CFO, this is your time to shine, as the CEO and CIO count on you to help drive change. How can you make the most of digitalisation to adapt your finance office to a new world? Here’s what Delaware can do for you.

Connection is key for transformation success. “A transformation will only succeed when you consider business challenges combined with technology, as well as processes and people,” says Mathieu van de Poel, Finance and Performance Management Lead. “That’s why Delaware decided to embrace the connected transformation approach. It’s the best possible approach to help businesses successfully accelerate change and get real value from their efforts.”

While traditionally a technology expert, Delaware is increasingly building integrated teams of weathered technology and management consultants. Mathieu has decades of experience in management consulting and is delighted to share his expertise with Delaware customers today: “business and technology consultancy have collided. Now that every transformation involves a great deal of digitalisation, firms need help from consultants who can look through different lenses.

By combining business and technology from the start, Delaware is well positioned to provide valuable advice on processes, people and technology. In a second stage, we can then implement the required tools and provide change management to ensure smooth adoption. In this way, we become a trusted sparring and implementation partner for CFOs who are looking for ways to thrive in the face of disruption.”

We want to be a trusted sparring partner for CFOs who are looking for ways to thrive in the face of disruption. By combining business and technology, we can provide the best advice, then help in implementing the change.Mathieu van de Poel, Finance and Performance Management Lead

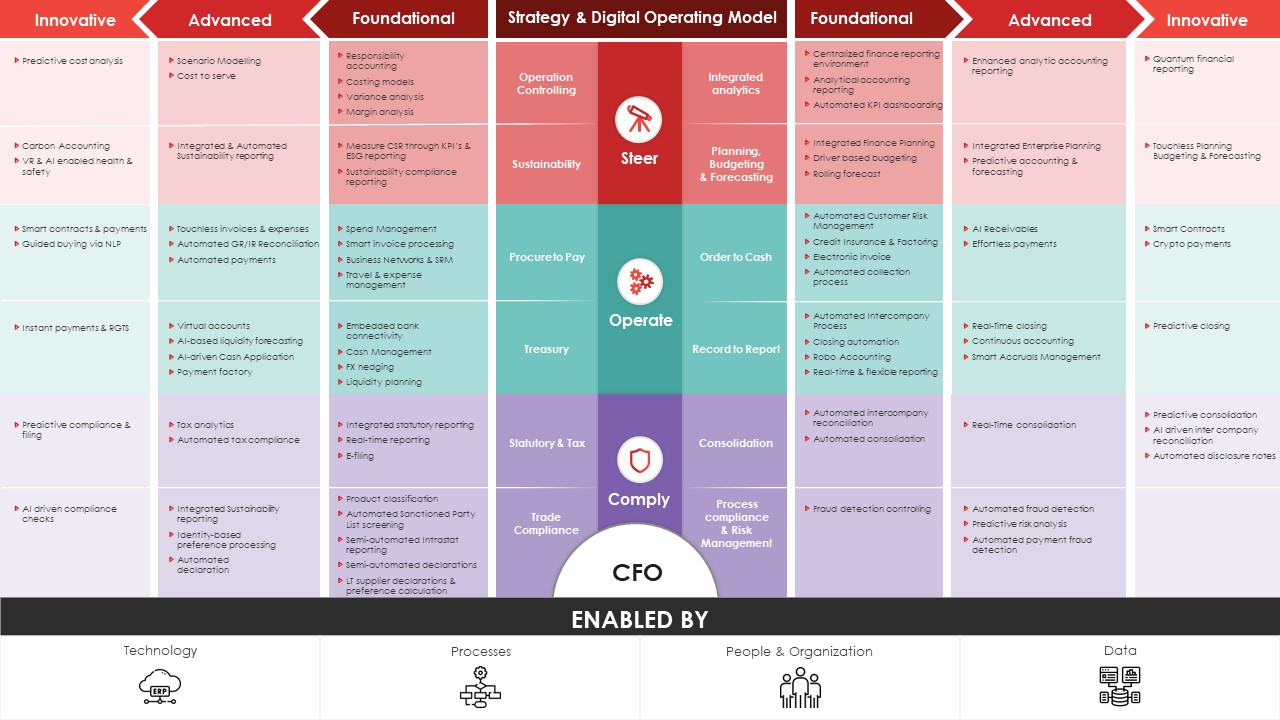

Just recently, Mathieu and his colleagues elaborated a model that visualises all the business needs of CFOs and links these to available technology: the CFO Connected Transformation model. At the heart of the model are the key business responsibilities of the CFO (steer, operate and comply) and the related operational processes (order to cash, procure to pay, sustainability, …). The model then lists all the technology that is at hand to support these processes, ranked from foundational to advanced and innovative technology.

Click here to enlarge the CFO Connected Transformation Model

The CFO Connected Transformation model is the basis in every meeting that we have with a CFO. It serves as an inspirational tool, but can also be used as a roadmap for CFOs to gradually move towards becoming a future-proof CFO office,” Mathieu explains.

When embarking upon a finance transformation journey, our expert team of finance and tech experts uses our trusted, four-step Think, Plan, Act methodology – which always starts with a finance diagnostic exercise.

“Whether you want to transform one particular finance process or overhaul your entire finance organisation, never rush into the project. Taking one step back will help you get your move right first time,” says Mathieu.

So, diagnostics is the very first step in every project. No matter how big or small a customer’s ambition, we always start with an intake plus one or more interviews and workshops with the customer. These sessions allow us to understand the existing finance organisation, define the customer’s finance maturity profile, and map the expectations and aspirations. That assessment guides us in the next phases of our project, from the ‘dream’ inspiration sessions through to defining the scope and drafting a realistic and tangible finance of the future roadmap.”