One solution for all your e-invoicing needs

Electronic invoices: they’re a hot topic for organizations of all sizes around the world. In Belgium, for example, sending B2B e-invoices will become mandatory in January 2026. And the ViDA proposal (VAT in the Digital Age) aims to enforce e-invoicing for all cross-border B2B transactions in the EU in 2028. While invoicing formats may differ per country, the goal is the same: control business transactions to further digitalize the economy, increase efficiency, and prevent tax evasion.

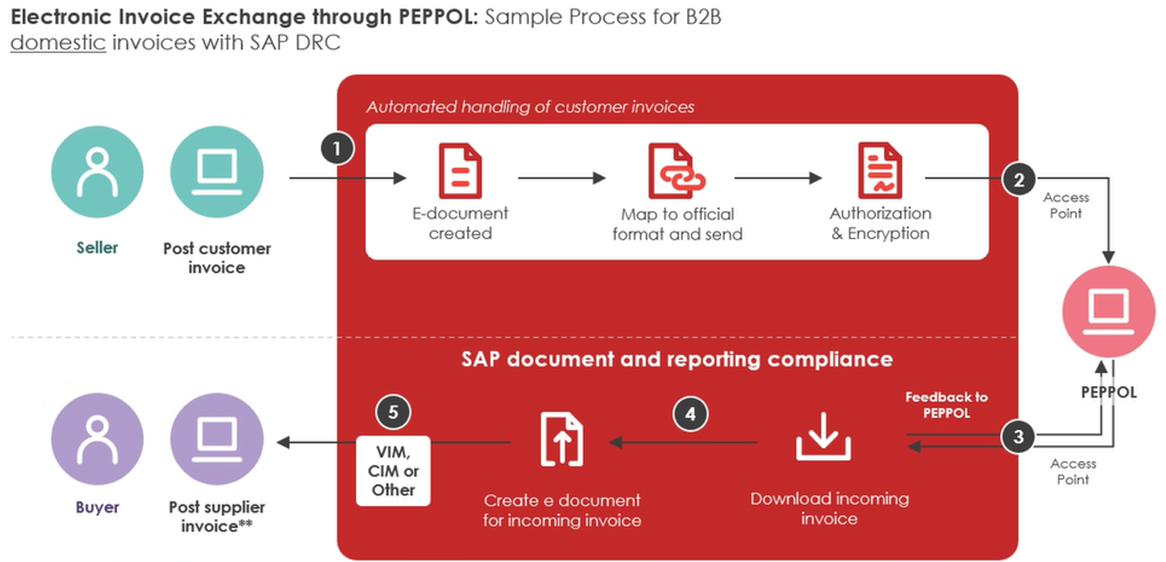

Amid this e-invoicing frenzy, SAP users don’t need to worry. SAP DRC (Document and Reporting Compliance) is a centralized, standardized solution for e-documentation management – both incoming and outgoing documents – from creation to submission and retrieval. That includes both real-time reporting (the focus of this page: invoices, purchase orders, etc.) and periodic reporting (e.g., monthly VAT returns).

Thanks to its global coverage, the platform takes care of the e-invoicing complexities for every country you serve, regardless of its formatting requirements. Whichever e-document you need to communicate to the authorities or other relevant parties, you will do so in complete compliance.

/Woman-holding-laptop-(1).webp?mode=autocrop&w=320&h=240&attachmenthistoryguid=303eed2f-b0b5-4631-a1e6-418dc46b9f8f&v=&c=3fab4b7641f0efab298668a66d39e661b85d370feb68a60b9c27a0235b035277)